Dave Ramsey's Baby Steps Explained

If you’ve been hanging around here for any length of time, you may hear me talking about Baby Step 2—a lot. Just what are the baby steps and what do I mean when I talk about them? In this post, I explain the baby steps so you can tackle your financial goals. Let’s dive in.

Dave Ramsey’s Baby Steps Explained

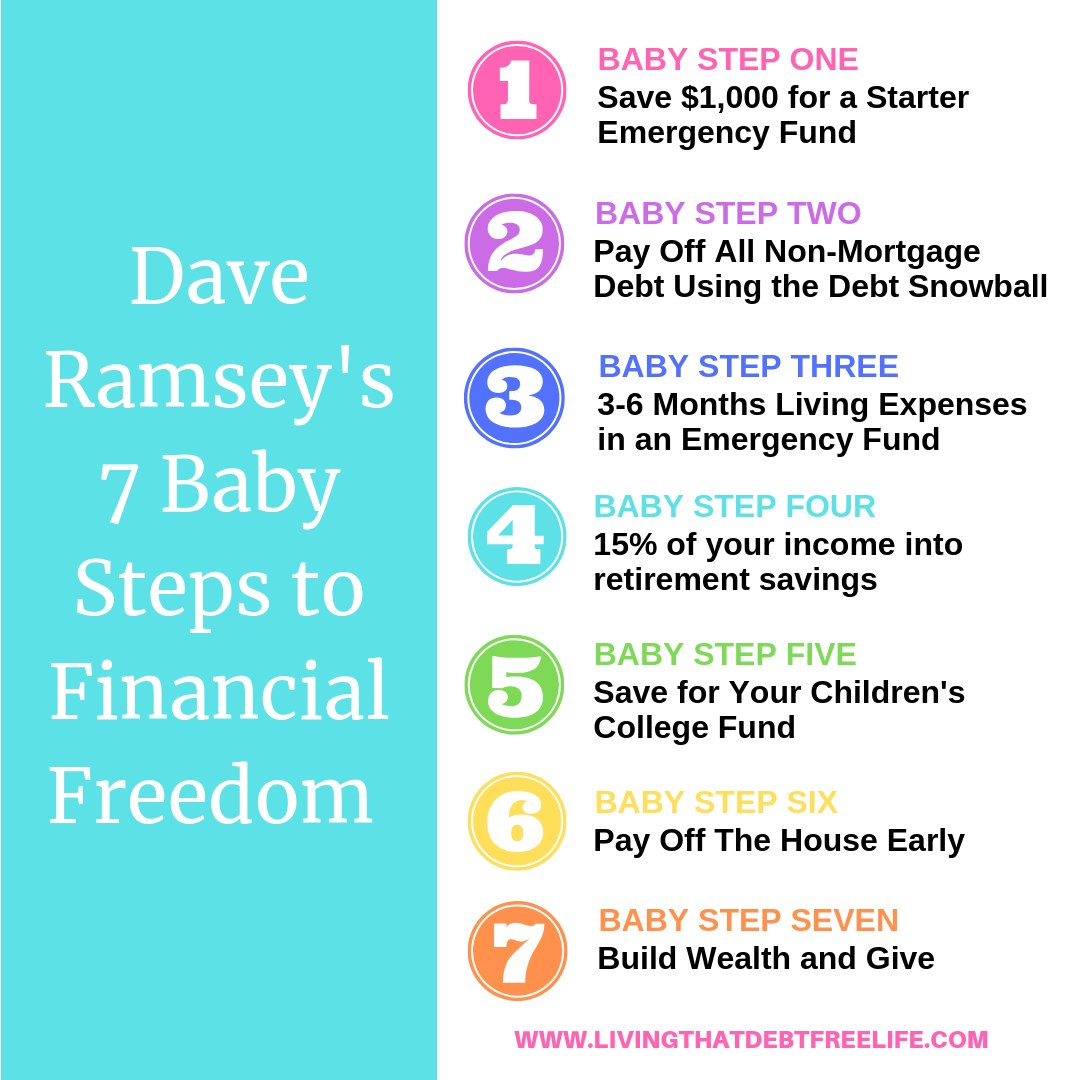

Dave Ramsey is the author of the book, The Total Money Makeover, and host of the radio show, The Dave Ramsey Show. He is directly responsible for getting me fired up about learning about all things personal finance and motivating me to pay off my debt with a vengeance. He developed the “baby steps” to financial freedom, which is a simple guide to getting your financial life together, step by step. Check out the info graphic I made below, to get a quick review of the baby steps.

Dave Ramsey’s Baby Steps Explained

Step One: Save $1,000 for a Starter Emergency Fund.

In this step, your goal is to save $1,000 as fast as humanly possible. Like, in a month. Super fast. Save every spare penny, host a garage sale, pick up a few shifts driving for Uber or delivering pizza. You need to have this mini emergency fund in place before you start paying off your debt. This step is step 1 for a reason. The whole idea is to have an emergency fund you can tap into when a true emergency arises during your debt pay off. Having an emergency fund in place will prevent you from going deeper into debt if an unexpected emergency pops up. Do what you can to save up $1,000 ASAP.

Step Two: Pay Off All Non-Mortgage Debt Using the Debt Snowball.

Your goal in baby step 2 is to become completely debt free (except for the house). Pay off all your non-mortgage debt using the debt snowball method. And I mean ALL your non-mortgage debt. Car payments, your cell phone, student loans, credit cards, past due medical bills—the whole shebang!! With the debt snowball, you list all your debts from smallest to largest, and tackle them one at a time. When the smallest debt is paid, you roll the amount you were paying on that debt (minimums + extra) to the next on the list. Keep on going until all your debts are paid. This is my favorite way to tackle debt (and the method we used to help us pay off $91K in student loans so far in the last 2.5 years).

Step Three: Save 3-6 Months of Living Expenses in an Emergency Fund

Your goal in step three is to have a fully funded emergency fund. This is different from the mini-emergency fund in step 1. This emergency fund is the real deal, and should be equal to 3-6 months of living expenses. That’s right—expenses, not income. Now for some of you, your income and expenses may be pretty similar when you are first starting out on this plan. But as you work the plan and eliminate debt after debt, your expenses obviously go down. And if you’ve been using a zero-based budget and tracking your expenses throughout your journey (which I recommend you do!), you’ll have a really good understanding of what your living expenses are by the time you reach this stage.

NOTE: Sometimes Dave refers to a Baby Step 3B, which is to save a 20% down payment for a home. If you haven’t bought a home yet, doing it before this step is a surefire way to get yourself into financial trouble. Buying a house while you are burdened with debt isn’t the best idea, because something always comes up. Replacing the roof, a new HVAC unit, or being told by the home owner’s association you have to replace your worn out fence can all easily cost thousands. (FULL DISCLOSURE: Despite the foregoing, we did buy a home while we were still in debt, and have lived to tell the tale! Knock on wood nothing devastating happens before we get to the end of baby step 2!!).

Step Four: Invest 15% of Your Household Income into Retirement Savings

Now, it’s time to start saving for your future. In this step, your goal is to sock away 15% of your household income into retirement savings. Dave recommends first contributing to your 401(k) up to the company match and then funding your Roth IRAs. Two of my absolute favorite books on investing are The Simple Path to Wealth and How to Retire Early. Seriously, if you’re a beginner and clueless about investing, both of these books explain the concepts in easy-to-understand, no-nonsense, straightforward language. How to Retire Early even walks you through everything you need to do/think about to make early retirement a reality for you.

Step Five: Save For Your Children’s College Fund

Man, if there’s anything I wish for my son, it’s that he isn’t burdened with hundreds of thousands of dollars in student loan debt like I was. We started a 529 Plan for him when he was born, but haven’t been contributing while we are on baby step 2. I can’t wait to start funding his college to help prevent him from facing the financial stress I had related to student loans.

So, your goal for step 5 is to fund your kid’s college. Dave recommends using a 529 or ESA (Education Savings Account) for this. Remember, you don’t have to fund 100% of your children’s educations, so take some time and figure out how much you want to fund and then devise a plan and start saving. If you don’t have kids, you get to skip this step and head right on to baby step 6.

Step Six: Pay off The House Early

In this step, your goal is to pay off the house early. Who wants to be heading into retirement still making mortgage payments? Um, no one. What’s worse, having a hefty mortgage payment may prevent you from being able to retire when you want to altogether. Can you imagine how amazing it will feel once you reach this step? No debt at all. Not a payment in the world! There must be no greater freedom than that, my friends. And I, for one, can’t wait to be there, several years from now, telling you EXACTLY how it feels!

CAUTION: Dave advises you do baby steps 4, 5, and 6 all at the same time, which is fine. However, my advice to you is to prioritize paying off the house over your kids’ college fund when completing these steps together. Your children can get scholarships or grants or work their way through college and pay for it themselves, if need be. However, who is going to be saving you in retirement if you haven’t adequately planned for it? The U.S. Government? Social Security? Ha! Let me know how that works out for you. No, you need to make sure that you can care for yourself in retirement, that you are financially secure, and that you don’t become a burden on your children financially. For those reasons, make sure you have your house 100% paid for when heading into retirement.

Step Seven: Build Wealth and Give

Baby Step 7 is the end of the road—the dream we are all striving for. In this step, you can “live and give like no one else,” as Dave says. Invest your financial surplus and keep building wealth. Give in ways you’ve never been able to before because you’ve been so financially burdened by poor financial decisions. You are finally free!! As Dave says, you know what you can do when you don’t have any payments? Anything you want!

So What Do You Think?

This isn’t my plan, but I couldn’t love it more for giving me definite step-by-step instructions to getting my financial life in order.

When I first started trying to clean up my financial mess, I knew I had a lot to do, but I didn’t know what I should do when, or if I should try to tackle it all at once.

That’s why I love Dave Ramsey’s plan. He lays it all out for you and tells you exactly what to tackle and when. I love the focused attention the plan requires you to give to each step.

I don’t know about you, but if I’m trying to get a million things accomplished all at once and spreading myself too thin, I’m only mediocre at accomplishing those things—and if I’m being honest, won’t even get half of them accomplished. When I focus on just one goal at a time, I’m so much more successful at meeting my goals.

So there you have it, buddies. I hope this gives you some guidance as you work your way toward financial freedom. And know that I am working this plan right along side of you and cheering you along every step of the way!!