February 2019 Monthly Spending Report and Debt Update

Welcome to my February Monthly Spending Report and Debt Update! In this post, I’m going to be sharing a recap of my monthly income and expenses, so you can see exactly how my budget and debt pay-off went this month!

Before we get started, let me share a quick recap of how we budget in our house.

My husband and I keep our money separate.

To begin, my husband and I keep our money in separate checking accounts.

Gasp. I know. Yes, we’ve been married 7 years already, and yes, I know Dave Ramsey says to combine finances. But, honestly, I’m just not at that point yet. He’s a spender and I’m a saver, and I think combining finances—with two people spending from the same pile of money—sounds like a disaster to manage. If combining finances works for you, fantastic! It’s just not what we’ve chosen to do in our home.

My husband and I split the bills.

My husband and I split the bills. I take the mortgage, home owner’s association dues, and property taxes. He takes everything else (car insurance, utilities, and groceries, and cash flowing college for his 20 year-old son). This works for us.

I share my half of the budget.

Hubs isn’t completely on board with sharing 100% of our income and spending plans with complete and total strangers on the internet. Thus, the budget recaps you’ll see here are my portion of the budget only. But, I will share real honest numbers with you, so hopefully you’ll get a feel for how a real budget works and functions.

OK, with all that out of the way, let’s get started!

Income

My total income for February 2019 was $6,692.74, broken down as follows:

$5,538.66 from my regular paycheck from my regular job as a civil defense attorney.

$117.27 from affiliate marketing for a home decor blog I started in 2017 and have basically completed abandoned. (If you’re interested in finding out how to earn money with affiliate income—you don’t need a blog!—see this post!).

$150.23 from side hustle income earned through Ebates.

$186.58 Other blog income, including Google Ad Sense (ad revenue from my blogs) and personal finance coaching income.

$700 donated from hubs’ pay, for the purpose of making extra debt payments.

Spending

Each month, I create a zero-based budget, allocating my income across all budget categories, until I’m left with 0. You can see my actual budget for February in my saved stories on Instagram.

Any additional money that comes in during the month (in this month’s case, $117.27 in affiliate marketing income, $150.23 from Ebates, and $700 from hubs) goes straight to debt.

Here’s how I spent the money in February:

Mortgage - $1,770. We have a 30-year fixed rate mortgage (which I wish was a 15!). We ultimately plan to pay it off FAR sooner, once we tackle our non-mortgage debt and beef up our emergency fund.

Life Insurance - $49. I pay monthly for a 20-year level-term life insurance policy.

Cell Phone - $171. Yes, this is painful. And yes, it’s only one cell phone. I have AT&T and unlimited everything. Too nervous to make the switch to a budget cell phone provider, but maybe one day.

Student Loan - $3,010.63. This includes my $375.63 minimum payment plus $2,635 in extra payments. Our student loan is the only debt we have, and we have an ambitious goal of paying it off in 2019. A further breakdown of how I was able to pay $2,635 in extra payments is down below.

Gasoline - $124. I drive, at a minimum, 50 miles to and from work each day, and sometimes I drive extra for work, attending hearings/mediations/depositions, etc.

Parking - $17. These expenses are reimbursed to me through my job.

Tolls - $120. I have a 3-hour daily commute (an hour and a half each way—JUST to drive 25 miles in horrific Houston traffic). I happily pay extra to REDUCE my drive time down to ONLY three hours a day. This is ridiculous, I know. But, it’s the nature of the beast, and something I’ll gladly spend money on for now, even though it’s outrageously expensive.

Entertainment - $19. This figure is what we pay for Netflix/Hulu.

Medical/Dental - $161. A doctor’s visit and a prescription.

Groceries - $78. My husband handles the groceries out of his budget, but I picked up some things here and there this month out of my budget.

Eating Out - $82. Always my biggest budget breaker, and even though I budget for eating out separately, I always end up using both my fun money and eating out money for eating out.

Save As You Go - $31. I bank with Wells Fargo, and I’m enrolled in a program that takes $1 from your checking account every time you use your debit card and puts it in your savings account. It’s an easy way to automate savings and helps build your savings up, over time, and you barely notice.

Miscellaneous - $23.

Pets - $33. I don’t even have pets, but my Mom fell on some hard times and I picked up some pet food for her.

Birthdays - $100. Deposit for my son’s birthday party.

Clothing - $106. I rarely buy clothes. In fact, I never include any money for clothes in my budget. But y’all, I have gained quite a bit of weight lately and I was looking pretty gross in my clothes and just finally had to break down and get some new things.

Beauty/Makeup - $41. Makeup, shampoo and conditioner.

Subscriptions - $24. This is for Dropbox and Pic Monkey. I cancelled Pic Monkey in February, so I will be eliminating $12.99 from the budget going forward. Yayy!

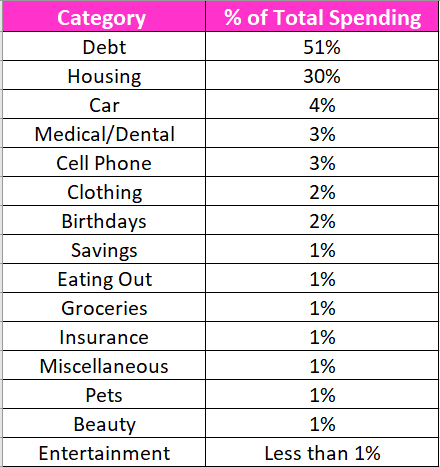

Spending Breakdown By Category and Percent

Here’s a breakdown by category and percent of my total monthly spending. I love that the biggest category is debt payments! This means that I’ll be able to free up 50% of my budget when the debt is completely paid!!!!

Sinking Funds

For more information on how I manage my sinking funds, and the 5 sinking funds I think every budget should have, see this post!

This month, we spent a total of $700 on sinking funds, broken down as follows:

Birthdays/Other Gifts - $200. My son gets invited to no fewer than 6,487 birthday parties a year, so this fund really helps when those unexpected gifts need to be purchased. I also use this money to plan my son’s birthday party, which, this year, is at a Laser Tag/Arcade funplex.

Christmas - $200. Each payday, I add $100 to a Christmas sinking fund. By the end of the year, I have $2,400 to spend on Christmas!

HOA Dues - $100. I add $50 every payday to an Homeowner’s Association Dues sinking fund, so I can pay the dues without stress or worry when they come due at the end of the year.

Medical/Dental - $200. This month, I put $100/payday into my medical/dental sinking fund. I dipped in to it this month for a doctor’s visit and a prescription, and it was so stress free knowing the money was there, specifically allocated for that purpose.

Debt Payments

In addition to my standard monthly payment of $375.63, I make an additional payment to my student loan (my only non-mortgage debt) on each payday. My extra payments this month totaled $2,635.00.

Here, I break down those 2 extra payments, so you can see exactly how it’s done!

NOTE: When I budget, I usually round up, instead of budgeting the specific bill amount. Anything left over, I throw at the debt.

Extra Payment - February 1, 2019 = $1,430.00

For this extra payment, $889.33 came from the February 1 paycheck. (See my exact budget for this paycheck on Instagram, in my saved stories). But, where did the rest of the money come from?

$500 came from hubby’s pay

$1.68 came from my life insurance payment leftover (I budgeted $50, but the actual amount is only $48.32)

$0.05 leftover from my cell phone bill

$1.64 leftover from Netflix

$37.30 left over from my “cushion/buffer” that I didn’t spend, bringing the total to $1,430

Extra Payment - February 15, 2019 = $1,205.00.

For this extra payment, $679.17 came from my February 15 paycheck. But, where did the rest of this money come from?!

$267.50 from my side hustle paydays

$58.33 left over in my buffer/cushion envelope from the prior payday

$200 donated from hubs’ pay

Total Debt Update

I began my debt free journey in January 2017 with $104,901 in student loan debt. I started this month (February 2019) with a student loan balance of $44,907. As of February 28, 2019, the balance is $42,088. With this month’s debt payments, I am officially at 59% PAID!! Whoop!!

And that’s a wrap! How about you?

How did your budget and/or debt repayment go in February?

Are you making progress on your 2019 financial goals?

Do you have any questions about budgeting? Leave them in the comments below!

Don’t forget to pin this article so your friends can see, too! Just click the image below!