2019 Personal Finance Challenge - February - Track Your Spending

Welcome to the Living That Debt Free Life 2019 Personal Finance Challenge!

If you are new to budgeting, paying off debt, and managing your finances, you’ve come to the right place! I’ve compiled 12 monthly challenges to get your 2019 financially on track.

Each monthly challenge contains one of the many steps I’ve taken to help me pay off debt faster.

If you’ve been paying off debt for a while, the information in these challenges is probably nothing new to you.

But, if you’re one of the hundreds who ask me each month how I’ve managed to pay off so much debt, then this is going to be so helpful to you!

The challenge is completely free to join! Each month, we’ll complete the challenge together and chat about it here on the blog in the comments down below and on Instagram.

I’ll announce each monthly challenge here on the blog and on my Instagram Page.

If you are participating, please feel free to leave a comment down below and let me know how it’s going! And, be sure to tag your challenge-related IG photos with #TDFL2019Challenge, so I can find you and cheer you on!!

Ready to get started?! Here’s this month’s challenge!

(For last month’s challenge, see this post!)

February 2019 Challenge - Track Your Spending

This month’s challenge is to track your spending. Admittedly, I’ve never been very good at tracking my spending, so I’ll be struggling right along with you this month!

There are lots of ways to track your spending—and it doesn’t matter HOW you do it, as long as you just do it.

Ways to Track Your Spending

1. Use An App to Track Expenses. There are plenty of expense tracking apps available. Here are some of the ones that come highly recommended from my Instagram followers who have used them and love them: Mint (this one is free), Every Dollar (free and created/recommended by Dave Ramsey), Good Budget, (charges a monthly fee) (Side Note: My hubs uses Good Budget and LOVES it), and YNAB (charges a monthly fee, but people really love this one, too!).

2. Use Pen and Paper to Track Expenses. This is what I have been doing until can find an app I really love. (Not that I dislike the apps above, I just haven’t spent enough time yet getting to know and use them yet).

3. Rely on Your Banking App to Automatically Generate Spending Reports for You. A lot of bank apps will automatically generate monthly spending reports. I bank with Wells Fargo and at the end of every month, they send a message in their app that categorizes my spending, complete with nifty charts and graphs. If you are a heavy cash envelope user, though, this option won’t be perfect, and may not be the best for you. But if you’re a lazy expense tracker, then using your bank’s app may be the jump start you need to start tracking your expenses.

How I Like To Track My Spending

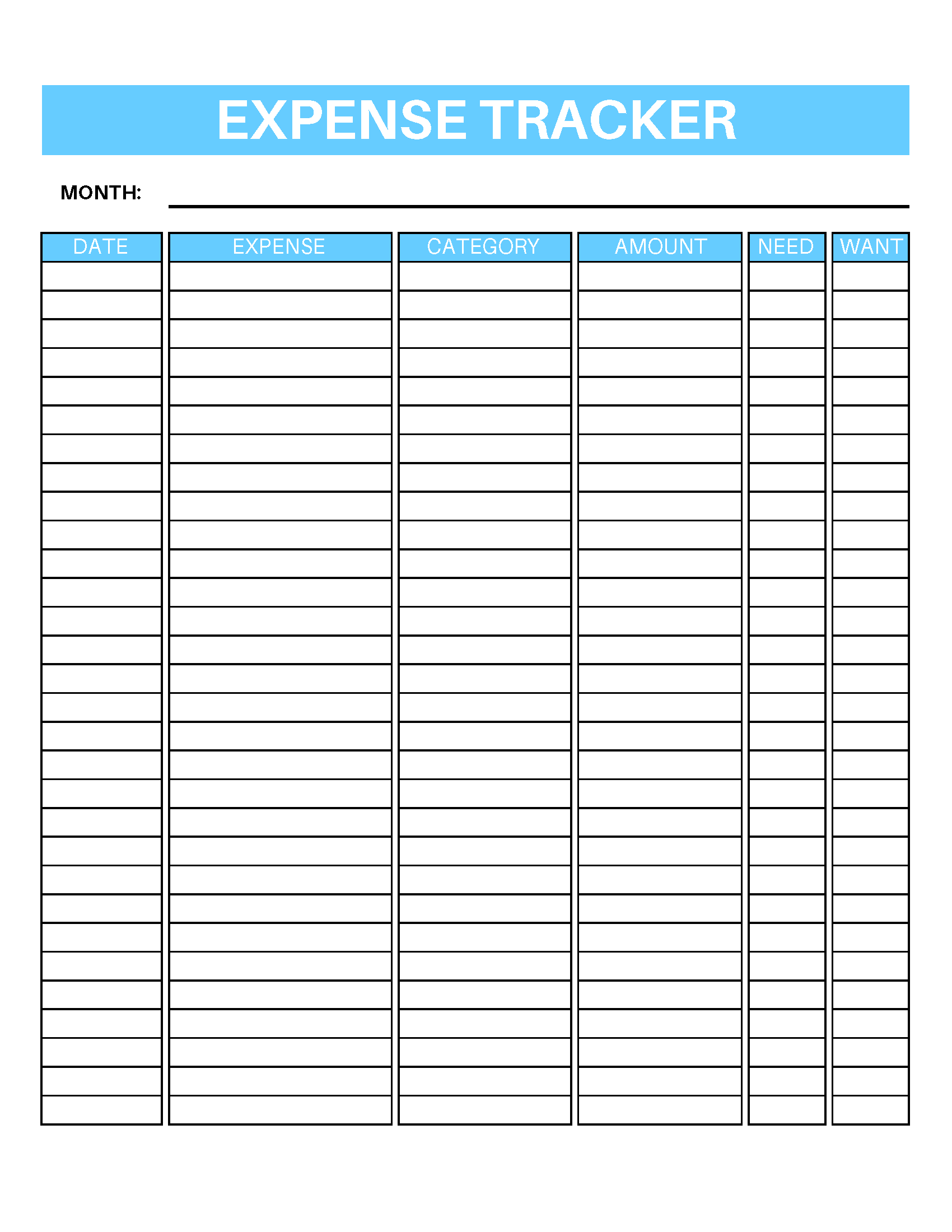

I like to track my spending by category and transaction, and I also like to record whether the expense was a want or a need. At the end of the month, I can review my expense tracker and see how much of my spending was essential and how much was just wants.

And if you complete this challenge and realize a whole ton of your spending is wants—fear not and don’t be discouraged!! That’s actually great news—because it means you’ll have plenty of discretionary spending to cut, in order to meet your financial goals even faster.

Free Printable Expense Tracker

As a special incentive to my email subscribers, you can get the exact Expense Tracker I use for free by clicking HERE. It lets you record each transaction, category, and amount, and it also lets you record whether the expense was a need or a want.

Ready to get tracking?! We’ve got this!!!

Don’t forget to tag your social media photos with #TDFL2019Challenge!! I want to encourage you and cheer you on this month!

Then meet me back here next month for March’s challenge! Good luck, everyone!! You’ve got this!!

Oh! And for bonus points, complete January’s Challenge again this month, in connection with February’s challenge. I do them both each month!

Happy Tracking!!